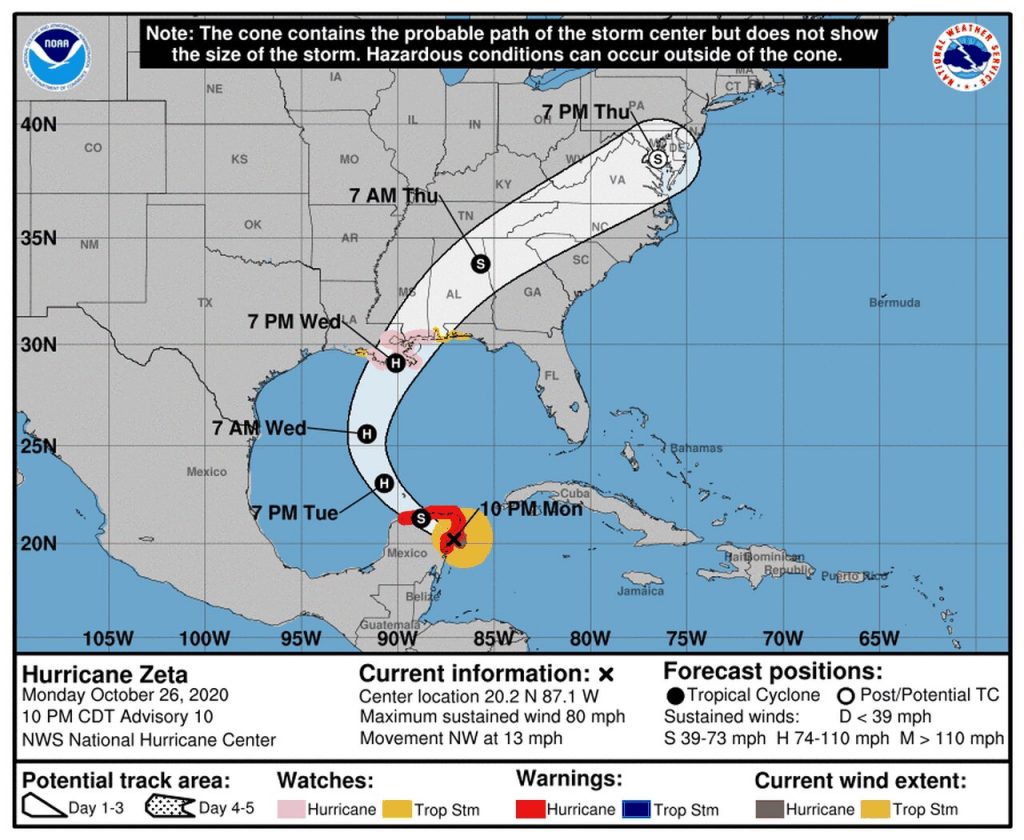

Unexpected Damages or Loss to your home can be quite stressful, often times paralyzing. Natural events, such as major storms and hurricanes in addition to other events that are out of control can leave a trail of damage adding up to a costly result. Floods, Major Storms, Fires, Vandalism, and other costs that arise with minor or major property damage, are the main reasons HomeOwners religiously pay for their insurance policy. As a Florida homeowner, or rather any homeowner, insuring such big investment is vital to protecting its longevity through life events. With that being said, why are statistics showing so many policy-holders getting the short end of the stick? And how can a Public Adjuster help with this problem?

What the average HomeOwner needs to know is that when it comes to construction estimating, it is a negotiation. On average, an insurance company has more knowledge of laws and codes related to property damage than a homeowner. However they are also known for under-valuing the amount a policyholder receives after loss has occurred. In addition to this hindrance, the process itself is quite lengthy and complicated, to one who is not well versed in property damage settlement this can be daunting and even frightening. As a result, dealing with an Insurance claim can be either ineffective, stressful, sometimes even both! That is where a public adjuster comes into play.

Public adjusters are experienced in fighting on the HomeOwners behalf, handling the claim process, and ensuring the maximum settlement the Policy Holder deserves. Whether it is the beginning of the process, filing a new claim, or reopening an underpaid claim, public adjusters do the work and the HomeOwner collects the check. With no cost to a HomeOwner to have an adjuster inspect a home, it is important that Policy Holders take advantage of this support and assistance. Whether you have filed or need to file a claim, a Public adjuster assures you get the full benefits you are entitled to.

Something important to note, doing research on the Public Adjuster you hire is pivotal. Inexperienced adjusters, or adjusters known for representing Insurance Companies, should be avoided completely. Scam artists have even been known to impersonate as Public Adjusters, taking advantage of policy holders. Checking your Adjusters references, asking questions, and picking your adjuster carefully ensures you will have the best assistance when filing a claim. Working with a Public Adjuster who only represents the Policy-Holders is definitely the route to go.

How does a policy-holder become “whole” after a home or property gets damaged? After a major event, or storm, a claim settlement allows for reimbursement for repairs needed, losses experienced, and funds required in the interim. It is crucial to know and understand the Policy Declaration, as it determines the actual limitations to a claim. By hiring a Public Adjuster, the HomeOwner gets what they deserve and on average receive 747% more. Yes that’s correct, by knowing the ins and outs, Public Adjusters settlements are what makes the difference in being able to rebuild properly.

Speak to a Public Adjuster near me, and you. Speak to a Sunrise Public Adjuster today!

What the average HomeOwner needs to know is that when it comes to construction estimating, it is a negotiation. On average, an insurance company has more knowledge of laws and codes related to property damage than a homeowner. However they are also known for under-valuing the amount a policyholder receives after loss has occurred. In addition to this hindrance, the process itself is quite lengthy and complicated, to one who is not well versed in property damage settlement this can be daunting and even frightening. As a result, dealing with an Insurance claim can be either ineffective, stressful, sometimes even both! That is where a public adjuster comes into play.

Public adjusters are experienced in fighting on the HomeOwners behalf, handling the claim process, and ensuring the maximum settlement the Policy Holder deserves. Whether it is the beginning of the process, filing a new claim, or reopening an underpaid claim, public adjusters do the work and the HomeOwner collects the check. With no cost to a HomeOwner to have an adjuster inspect a home, it is important that Policy Holders take advantage of this support and assistance. Whether you have filed or need to file a claim, a Public adjuster assures you get the full benefits you are entitled to.

Something important to note, doing research on the Public Adjuster you hire is pivotal. Inexperienced adjusters, or adjusters known for representing Insurance Companies, should be avoided completely. Scam artists have even been known to impersonate as Public Adjusters, taking advantage of policy holders. Checking your Adjusters references, asking questions, and picking your adjuster carefully ensures you will have the best assistance when filing a claim. Working with a Public Adjuster who only represents the Policy-Holders is definitely the route to go.

How does a policy-holder become “whole” after a home or property gets damaged? After a major event, or storm, a claim settlement allows for reimbursement for repairs needed, losses experienced, and funds required in the interim. It is crucial to know and understand the Policy Declaration, as it determines the actual limitations to a claim. By hiring a Public Adjuster, the HomeOwner gets what they deserve and on average receive 747% more. Yes that’s correct, by knowing the ins and outs, Public Adjusters settlements are what makes the difference in being able to rebuild properly.

Speak to a Public Adjuster near me, and you. Speak to a Sunrise Public Adjuster today!

Public adjusters are experienced in fighting on the HomeOwners behalf, handling the claim process, and ensuring the maximum settlement the Policy Holder deserves. Whether it is the beginning of the process, filing a new claim, or reopening an underpaid claim, public adjusters do the work and the HomeOwner collects the check. With no cost to a HomeOwner to have an adjuster inspect a home, it is important that Policy Holders take advantage of this support and assistance. Whether you have filed or need to file a claim, a Public adjuster assures you get the full benefits you are entitled to.

Something important to note, doing research on the Public Adjuster you hire is pivotal. Inexperienced adjusters, or adjusters known for representing Insurance Companies, should be avoided completely. Scam artists have even been known to impersonate as Public Adjusters, taking advantage of policy holders. Checking your Adjusters references, asking questions, and picking your adjuster carefully ensures you will have the best assistance when filing a claim. Working with a Public Adjuster who only represents the Policy-Holders is definitely the route to go.

How does a policy-holder become “whole” after a home or property gets damaged? After a major event, or storm, a claim settlement allows for reimbursement for repairs needed, losses experienced, and funds required in the interim. It is crucial to know and understand the Policy Declaration, as it determines the actual limitations to a claim. By hiring a Public Adjuster, the HomeOwner gets what they deserve and on average receive 747% more. Yes that’s correct, by knowing the ins and outs, Public Adjusters settlements are what makes the difference in being able to rebuild properly.

Speak to a Public Adjuster near me, and you. Speak to a Sunrise Public Adjuster today!

Something important to note, doing research on the Public Adjuster you hire is pivotal. Inexperienced adjusters, or adjusters known for representing Insurance Companies, should be avoided completely. Scam artists have even been known to impersonate as Public Adjusters, taking advantage of policy holders. Checking your Adjusters references, asking questions, and picking your adjuster carefully ensures you will have the best assistance when filing a claim. Working with a Public Adjuster who only represents the Policy-Holders is definitely the route to go.

How does a policy-holder become “whole” after a home or property gets damaged? After a major event, or storm, a claim settlement allows for reimbursement for repairs needed, losses experienced, and funds required in the interim. It is crucial to know and understand the Policy Declaration, as it determines the actual limitations to a claim. By hiring a Public Adjuster, the HomeOwner gets what they deserve and on average receive 747% more. Yes that’s correct, by knowing the ins and outs, Public Adjusters settlements are what makes the difference in being able to rebuild properly.

Speak to a Public Adjuster near me, and you. Speak to a Sunrise Public Adjuster today!

How does a policy-holder become “whole” after a home or property gets damaged? After a major event, or storm, a claim settlement allows for reimbursement for repairs needed, losses experienced, and funds required in the interim. It is crucial to know and understand the Policy Declaration, as it determines the actual limitations to a claim. By hiring a Public Adjuster, the HomeOwner gets what they deserve and on average receive 747% more. Yes that’s correct, by knowing the ins and outs, Public Adjusters settlements are what makes the difference in being able to rebuild properly.

Speak to a Public Adjuster near me, and you. Speak to a Sunrise Public Adjuster today!

Sunrise Public Adjusters 754-400-7445 Intake@sunriseclaim.com