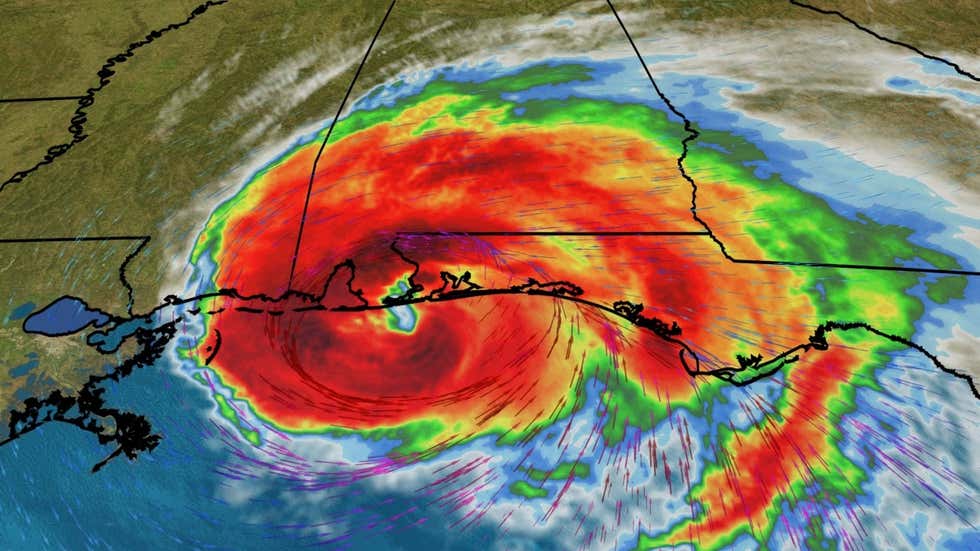

Great, you bought Insurance for your Property, giving you the peace of mind if damage should occur. However, Insurance Premiums can be a hefty thing, especially when talking about Premiums on your Home Insurance Policy. Understanding your Policy can help you save a few bucks on your Premium. Though Insurance is there to reimburse Policy Holders for any type of damage that occurs, is it really intended to cover small and large losses, alike? From a Broken Window, to huge damage from a Hurricane, where do you draw the line?

Filing a claim for minor loss to a Property may not the best idea. While a Policy Holder has a right to file a claim for any damage experienced, there are other things than just the loss, to take into consideration. Every Policy has a deductible, which is the amount that you pay out of pocket for an insurance claim before your insurance company pays for the remainder of the loss. This means the loss experienced would have to be worth more than the Policy Holders deductible, to see any type of reimbursement. It is for this reason, filing a claim should generally be limited to larger losses over your deductible amount.

To avoid any unwanted surprises, try to learn as much as possible about an Insurance Company’s policies, and protocols before filing a claim. Speaking to an Insurance agent or a Public Adjuster can help you determine whether to file a claim or not. Having a Public Adjuster, who is also familiar with Insurance company policies will assure that you maximize your claim, while remaining in good relations with your Insurance Company. If you have experienced a loss, ask your Public Adjuster today how to get the most out of your claim.

Speak to an Adjuster near me, and you. Speak to a Sunrise Public Adjuster today!

Filing a claim for minor loss to a Property may not the best idea. While a Policy Holder has a right to file a claim for any damage experienced, there are other things than just the loss, to take into consideration. Every Policy has a deductible, which is the amount that you pay out of pocket for an insurance claim before your insurance company pays for the remainder of the loss. This means the loss experienced would have to be worth more than the Policy Holders deductible, to see any type of reimbursement. It is for this reason, filing a claim should generally be limited to larger losses over your deductible amount.

To avoid any unwanted surprises, try to learn as much as possible about an Insurance Company’s policies, and protocols before filing a claim. Speaking to an Insurance agent or a Public Adjuster can help you determine whether to file a claim or not. Having a Public Adjuster, who is also familiar with Insurance company policies will assure that you maximize your claim, while remaining in good relations with your Insurance Company. If you have experienced a loss, ask your Public Adjuster today how to get the most out of your claim.

Speak to an Adjuster near me, and you. Speak to a Sunrise Public Adjuster today!

To avoid any unwanted surprises, try to learn as much as possible about an Insurance Company’s policies, and protocols before filing a claim. Speaking to an Insurance agent or a Public Adjuster can help you determine whether to file a claim or not. Having a Public Adjuster, who is also familiar with Insurance company policies will assure that you maximize your claim, while remaining in good relations with your Insurance Company. If you have experienced a loss, ask your Public Adjuster today how to get the most out of your claim.

Speak to an Adjuster near me, and you. Speak to a Sunrise Public Adjuster today!

Sunrise Public Adjusters 754-400-7445 Intake@sunriseclaim.com